Want to sell my house fast Florida

How much is my Florida house worth?

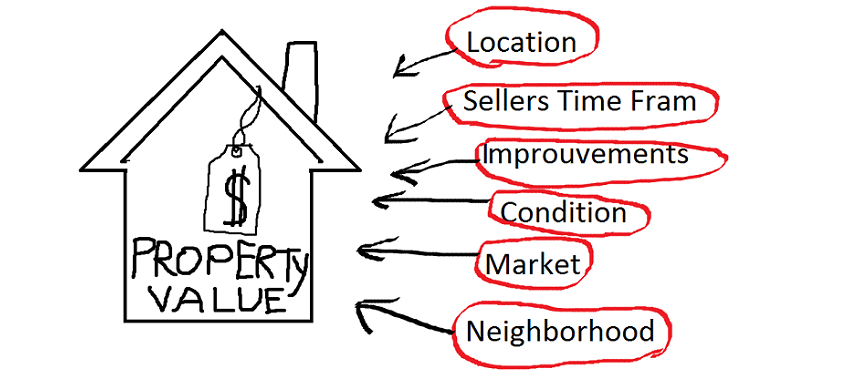

Property value is affected by many factors. When trying to understand the fair market value (FMV) of your house, keep in mind it’s not accurate science. A professional, certified appraiser, can only give you an opinion of value. The only way of really knowing what does your house worth is if you put it on the market and try to sell it.

However, there are several ways in which you could get an estimate or an idea of the FMV of your property:

– Look at your recent tax bill

– Find out about properties that sold in your area within the last few months

– Hire an appraiser

Your Recent Tax Bill:

As a homeowner, you might view your yearly tax bills as a nuisance that must be paid. The truth is that property tax bills have a lot more to discover than what you think.

We would advise any homeowner to read the bill or access it through the county instead of only paying it.

One of the things that appear in your tax bill would be the assessed value of your property. The assessed value is usually lower than the actual value by 10-20%. It gives you an idea of current value, and it’s the easiest way to get a preliminary estimate.

Properties that Sold Near Me:

It’s imperative to know the sale price of properties that sold in your area, especially in your subdivision.

When you hire an agent to list your house, the first thing the agent does is trying to understand the FMV of your property.

95% of agents work in the same way; they run a search in their system to find out what had sold in the area that has similar features.

For example, a homeowner wants to sell his\her property that has 2000 SF 3 bedrooms and 1 bathroom and hires an agent to list the property. the agent will search the MLS (multiple listing system) to see what had sold in the past 6-12 months in the area that has the same SF and the same bedrooms and bathrooms. This gives the agent an understanding of what people are paying for that type of property in the area.

You don’t need an agent necessarily to understand this information. If you know about a sale that occurred in your neighborhood – ask your neighbor homeowners what was the sale price. Visit For-Sale-By-Owner websites to see the value of properties in your area and what is on sale.

Remember: buyers don’t pay more for a house than the price of a similar house in the same neighborhood. It’s called: “the principle of substitution“, and it used as a guideline for professional appraisers too.

Hire an Appraiser:

An appraiser is the most professional authority in determining the value of a property, appraisers work by definite guidelines and can give you a market value that is based on multiple factors, including market condition, trends, major shifts in the area and zoning, scarcity in the area, supply and demand, etc. An appraisal could only be given by an appraiser. A real estate agent that gives you an assumption of the price is giving you a CMA (Comparative Market Analysis).

An appraiser’s work is determined by the work that is needed to perform the appraisal, whereas a comparative market analysis (CMA), given by an agent can sometimes be doubtful, because an agent will get a commission if the house was sold, so the CMA could be tilted by factors that contribute for a deal to be conceived, sometimes not in favor of the homeowner.

Warning:

When determining the value of your property, detach all emotions, as this is a game of numbers. Many homeowners tend to do that curtail mistake, they have lived in their home for years, and feel like their home is special, and that any buyer would be lucky to have their home. As a result, they price their houses in their mind as a price that wouldn’t be affordable for many buyers, like other homes in the area that offers the same amenities and features are being sold for less.

This scenario is one of the most commons in the real- estate market and many homeowners find themselves with a home on the market that doesn’t sell for months and even years, as people can see that it has been on the market for a long time, and potential buyers are thinking that it is probably a bad house and that this is why no one is buying it – and the cycle goes on and on and it gets worse with every day that passes by and the house hasn’t sold yet.